Payroll Detail Report

To find this report: Payroll > Reports > Payroll Reports > Payroll Details

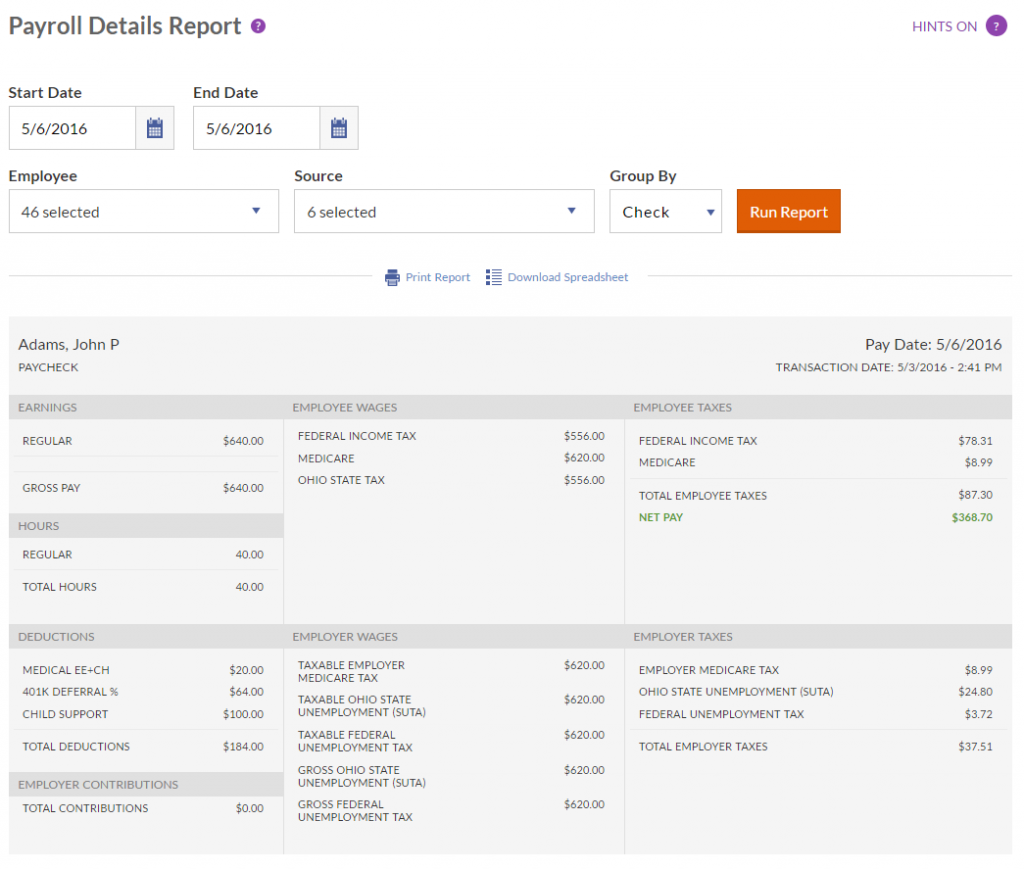

You can view one employee or all employees, and select the pay date range. This report is especially helpful your first year as a Patriot Software customer if you entered prior payroll information, as the report gives totals for prior payrolls and Patriot Software checks. By default, activities from all sources will be included in the report. You can also choose select one or multiple sources at a time:

- Paycheck: Any checks actually processed in Patriot Software.

- Payroll History: Year-to-date history you had entered for checks that were processed before you started using Patriot Software.

- Payroll Update: Any edits or corrections you made to checks in the payroll software.

- Tax Rate Change: If you made any changes to a tax rate that triggered a payroll adjustment, the adjustment details would appear here.

- System Edit: This source is not used often, and only happens if there is an automatic adjustment needed to your account.

- Prior Payroll Tax Adjustment: This is a result of any tax adjustments based on year-to-date history you had entered from a prior payroll provider.

- Voided Paycheck: Any paychecks you have voided.

You have four grouping options:

- Check: will display each check detail separately, including whether it was an actual paycheck, a payroll update, or a prior payroll history entry, and the check transaction date and time. Note the transaction date and times are in your company’s time zone.

- Pay Date: will aggregate all checks together for each pay date in the date range.

- Employee: will aggregate all checks together for one employee, helpful if you need to look up year-to-date earnings. This grouping is shown in the above sample screenshot.

- Total: will aggregate all employees’ checks together. Use this option to view the total for all employees.

You can export this information into a CSV file, for importing into another system. Click the “Download Spreadsheet” link under the selection dropdown boxes at the top of the report. A CSV file will download and contains all of the earnings, taxes, deductions, and net pay for each employee.

Related Articles

Payroll Register Report

The Payroll Register report shows all pay detail for each employee receiving a paycheck. This report is found under Reports > Payroll > Payroll Reports > Payroll Register. Hours & Earnings: Shows the number of hours and any additional money paid. ...Tax Liability Report

Reports > Payroll Tax Reports > Payroll Tax Liabilities By default, all of the taxes that apply to your state will be included. To change this, select each type of tax you want to include on the report. Enter the date range for the month or period ...Paycheck History Report

The Paycheck History report shows individual paycheck detail for checks processed in Patriot Software. Paycheck detail includes hours, earnings, employee taxes withheld, employer taxes owed, deductions, and contributions. It also shows any scheduled ...Assigned Deductions Report

The Assigned Deductions report shows all employee payroll deductions scheduled to happen in future payrolls. This report is found under Payroll > Reports > Payroll Reports > Deductions & Contributions > Assigned Deductions. Note this does not ...Viewing My Time-Off History Report

If your employer tracks time off, you can view details in the Time-Off History Report in your employee portal. Click “Time-Off History” under the Reports list. The Hour Code (such as vacation or sick time) will display at the top of the report. If ...