Paycheck History Report

To view paycheck history for a single employee:

1. Payroll > Employees > Employee List > click the employee’s name.

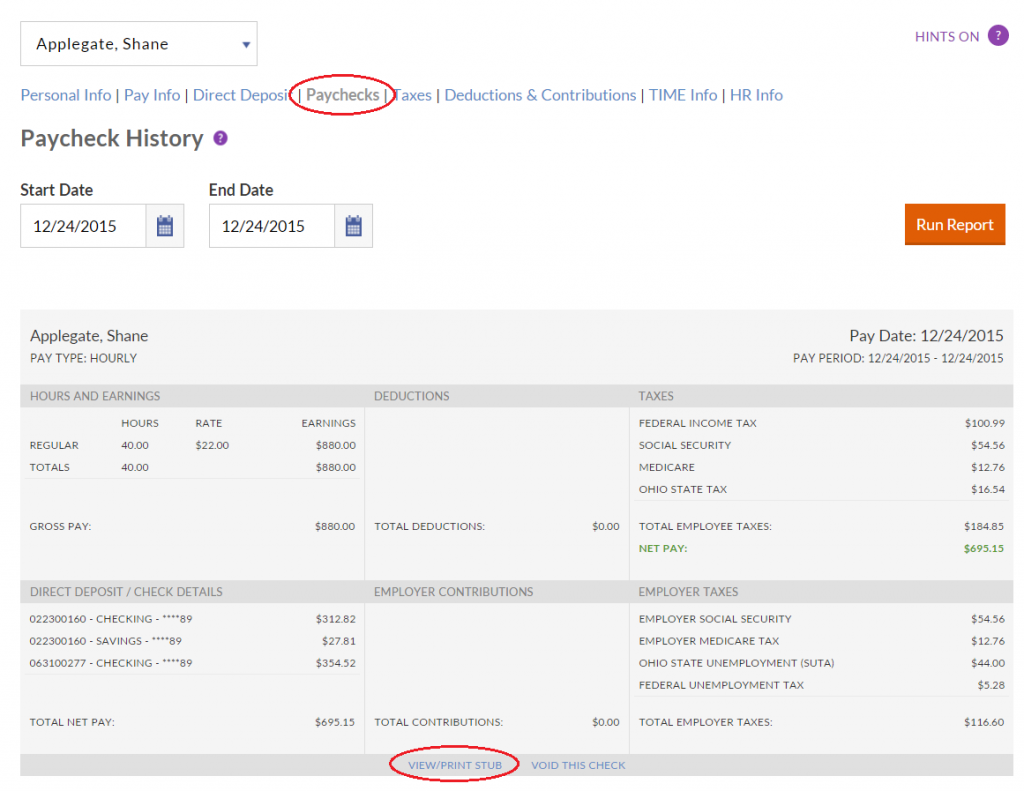

2. On the employee’s main screen, click the Paychecks link.

3. The employee’s most recent paycheck will display. To view a check for a specific pay date or range of pay dates, enter the paycheck date range, and click Run Report. You can also select a different employee from the name dropdown list.

4. To view and/or print the employee’s actual pay stub, click the View/Print Stub link at the bottom of each paycheck detail. A new web browser window will appear with the printer-friendly version of the pay stub. Print following your web browser menu.

5. You can also void an employee’s paycheck from this report. For more information, see How To Void A Paycheck.

Below is a sample report showing one check for an employee:

Related Articles

Payroll Detail Report

The Payroll Details report shows all payroll activity for employees, including prior payroll history entries, payroll updates, and paychecks processed in Patriot Software. Payroll reports like these can be used to break down taxes for employees, or ...Payroll Register Report

The Payroll Register report shows all pay detail for each employee receiving a paycheck. This report is found under Reports > Payroll > Payroll Reports > Payroll Register. Hours & Earnings: Shows the number of hours and any additional money paid. ...How To Void A Paycheck

When you void a check, you will reverse the payment made to the employee, including earnings, deductions, contributions, and all taxes. You can void multiple checks at a time. Note: If you are a Full-Service Payroll customer, you may only void ...Employee Portal: FAQ View My Paycheck

Viewing My Paychecks: FAQs Q. How soon can I view my paycheck? A. Your paycheck details will be available for viewing as soon as your employer finishes running the payroll. Q. Am I able to view more than one paycheck at a time? A. Yes. From the main ...Employee Portal: FAQ View my Paycheck

Viewing My Paychecks: FAQs Q. How soon can I view my paycheck? A. Your paycheck details will be available for viewing as soon as your employer finishes running the payroll. Q. Am I able to view more than one paycheck at a time? A. Yes. From the main ...