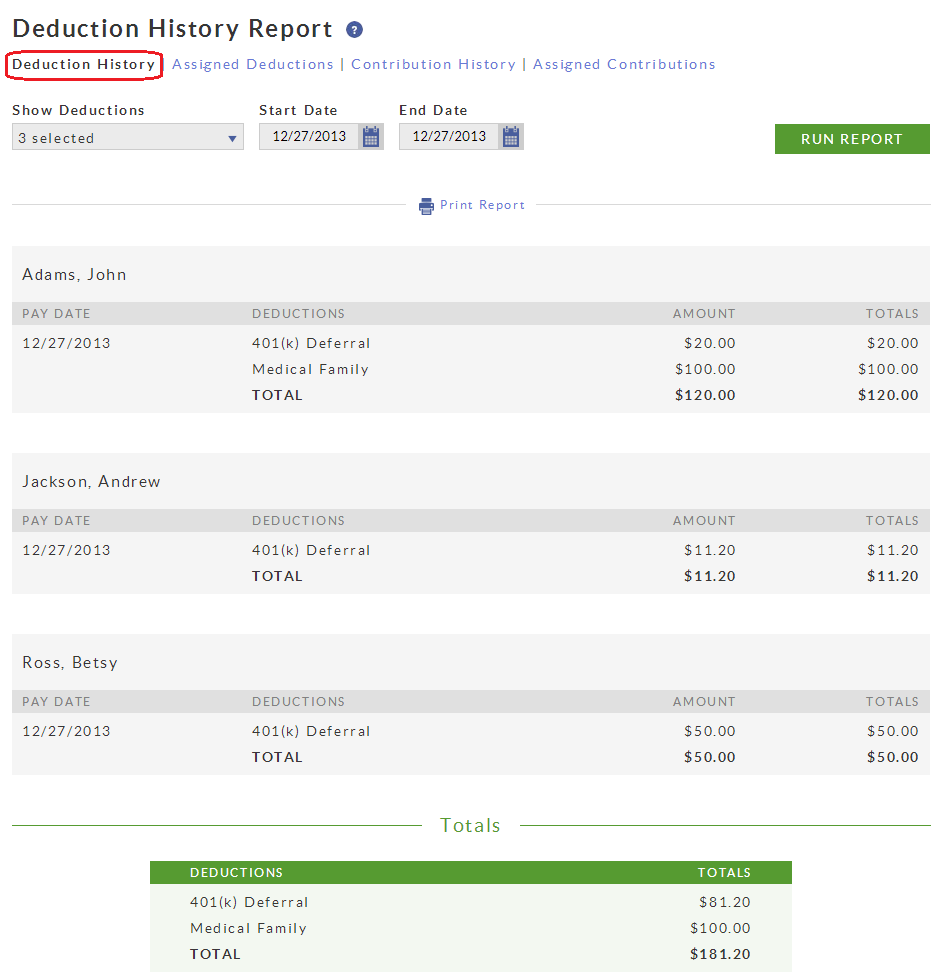

This report is found under Payroll > Reports > Payroll Reports > Deductions & Contributions > Deduction History.

You can see all deductions, or filter specific deductions by selecting the deduction in the list. The report is grouped by each employee, then by each paydate included in the report.