Background

A W-2 Form is a report of all employee income and tax withheld for a calendar year. This is needed in order for the employee to file their income taxes. The IRS requires that employers mail the W-2 to each employee by January 31st of the following year.

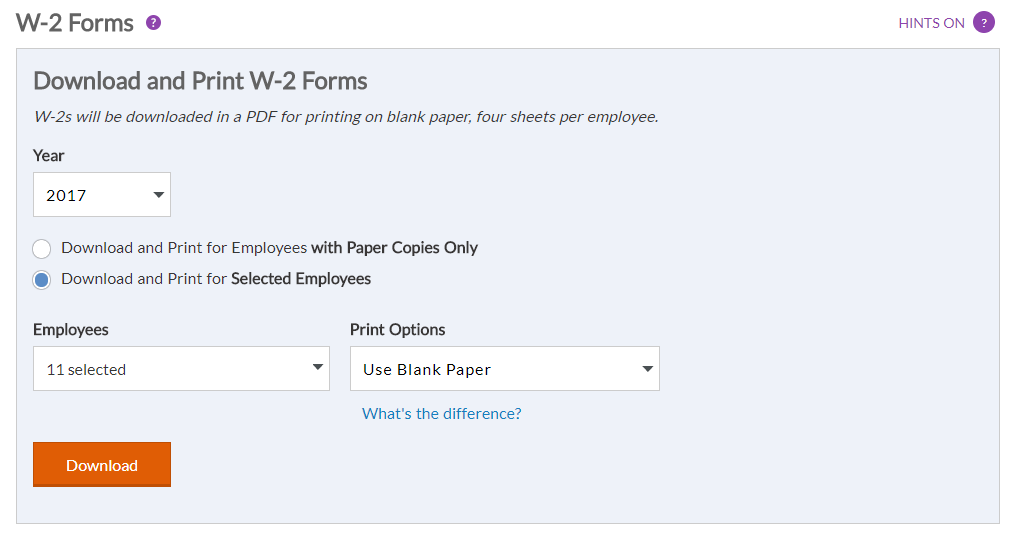

How to Download and Print W-2 Forms

Optional: Before you download and print your W-2s, you can run the Employee W-2 Summary Report to view the amounts for each employee to confirm everything is correct.

- Reports > Payroll Tax Reports > W-2 Forms.

- Select the year.

- You may have up to two options when selecting which W-2s to download:

- Download and Print for employees with paper copies only. This will produce a PDF containing W-2s only for those employees who have not consented to receive an electronic copy of their W-2 in their employee portal. For more details, see Employee Consent for Electronic W-2s.

- Download and Print for Selected Employees. If you need to download all or selected employee W-2s, choose this option and select the employees in the dropdown list.

- Select your Print Option. You have two options for printing W-2 Forms:

- Option 1: Use Blank Paper

- Option 2: Use Blank 4-Up Perforated Forms

- For details explaining the difference between these two print options

- Click “Download.” A PDF document will open showing the W-2 forms in the format you selected, for the employees you selected.

- Load either your blank printer paper or perforated blank forms in your printer, depending on your print option selection.

- Print W-2 forms from the PDF document. We recommend you save this document to your computer so you can reprint W-2s if needed.

Once you have downloaded your W-2s, you can now review them and post an electronic copy to each employee in their employee portal. See Posting Electronic W-2s in the Employee Portal.