You can view and make changes to your federal tax withholding in your employee portal.

From the main page, click “Federal Tax.” You can view your federal tax settings and history of previous W-4 updates. When you edit your tax settings, you will be completing an electronic version of the paper W-4 form.

To Edit Your Federal Tax Withholding

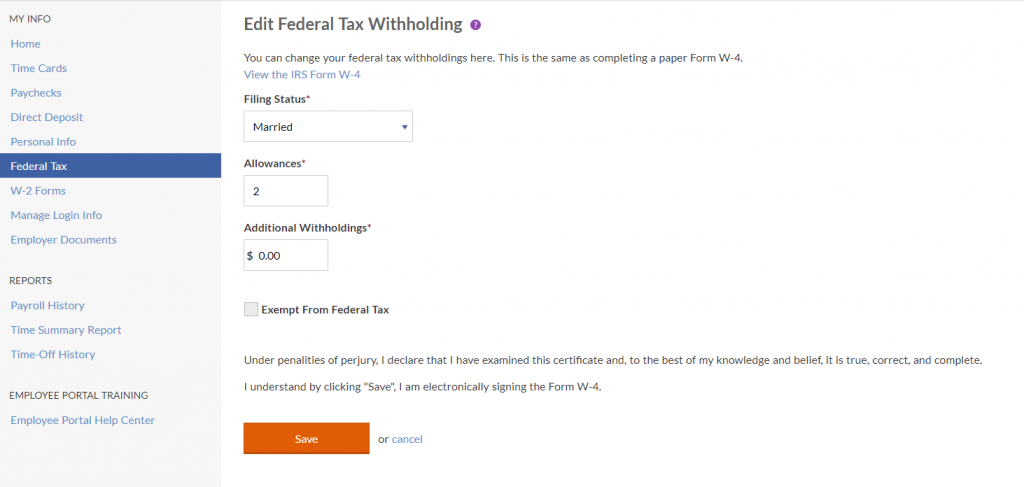

1. Click the Edit link. You can view the full Form W-4 certificate, which includes instructions and worksheets. You will see the following fields:

Filing Status: This is your federal filing status as listed in Section 3 of the W-4 form.

Allowances: This is the number of allowances you are claiming, listed in Section 5 of the W-4 form. If you are unsure how many allowances to claim, you can use the worksheet on the original form.

Additional Withholdings: This is the additional dollar amount, if any, that you would like withheld from each paycheck. This is listed in Section 6 of the W-4.

Exempt from Federal Tax: Most people are not exempt from federal tax. Only check this box if both of these apply:

- You had the right to a refund of all federal tax because you had no tax liability.

- This year you expect a refund of all federal tax because you expect to have no tax liability.

For more information, including a chart to help you decide whether you are exempt from federal tax, see IRS Publication 505.

2. Click Save. By clicking Save, you are electronically signing your W-4 form.

- When you save changes to the W-4, your employer will receive an automatic email notification that you have made changes.

- These changes will automatically update the payroll system. They will be in effect the next time your employer runs a payroll.